China Evergrande and Huarong have become examples of Chinese companies that have run up massive debts and are struggling to repay them AFPHector RETAMAL Cash-strapped debt collector Huarong Asset Management has announced plans to raise 66 billion by selling shares and divesting more assets as the deeply indebted Chinese state-owned firm tries to stay afloat. On 29 August China Huarong Asset Management Co Ltd.

China S Huarong To Receive State Backed Rescue As It Unveils 16bn Loss Financial Times

Huarong Amc Woes Drag On China S Bond Market

2799 Hk China Huarong Asset Management 002799 Share Pr

Chinese state-owned asset manager China Huarong Asset Management said on Wednesday it will receive fresh capital worth 42 billion yuan 659 billion from a state consortium led by Citic Group as part of a restructuring plan.

China huarong asset management. Huarong intends to issue a maximum of 3922 billion domestic shares and not more than 196 billion shares listed on the Hong Kong exchange to a consortium of investors including Citic Group China Cinda Asset Management and China Life Insurance among others. China Huarong Spokespersons Remarks on Recent Media Concerns. Headquarters on Financial Street in Beijing China on Wednesday May 19 2021.

Bloomberg -- China Huarong Asset Management Co. China Great Wall Asset Management - for the Agricultural Bank of China. The proceeds must be used mainly for its main business such as the acquisition and disposal of nonperforming assets and debt-to-equity.

China Huarong Asset Management Co the countrys largest manager of bad debt that went bad itself is edging closer to recapitalizing and repairing its balance sheet. Summary of Financial Adjustments. 中国华融 is a majority state-owned financial asset management company in China with a focus on distressed debt management.

Hong Kong AFP Cash-strapped debt collector Huarong Asset Management has announced plans to raise 66 billion by selling shares and. Jaquet who co-manages the US241 billion Seafarer Overseas Growth Income Fund cited Evergrande and China Huarong Asset Management as examples. Released announcements of 2020 annual results and 2021 interim results.

Signage illuminated at the China Huarong Asset Management Co. China Orient Asset Management - for the Bank of China. Cash-strapped debt collector Huarong Asset Management has announced plans to raise 66 billion by selling shares and divesting more assets as the deeply indebted Chinese state-owned firm tries to stay afloat.

It develops distressed property projects and provides property-related advisory to the parent. Huarong intends to issue a maximum of 3922 billion domestic shares and not more than 196 billion shares listed on the Hong Kong exchange to a. The Chinese government set up four major asset management companies in 1999 including the predecessors of Huarong and Cinda to defuse systemic financial risks at state-owned banks and tackle non-performing policy assets separated from state capital.

Huarong intends to issue a maximum of 3922 billion domestic shares and not more than 196 billion shares listed on the Hong Kong exchange to a consortium of investors including Citic Group China Cinda Asset Management and China Life Insurance among others. Plans to raise as much as 42 billion yuan 66 billion by selling shares to a group of state-backed investors and said it will divest more. Beijing aced its economic recovery from the pandemic largely via an expansion in credit and a state-aided construction boom that sucked in raw materials from across the planet.

It was one of the four asset management companies that the Government of China established in 1999 in response to the 1997 Asian financial crisis. China Huarong Asset Management said it would receive a bailout from five state-backed investors to stave off its bankruptcy as one of the first and largest of the countrys five managers of. 金融资产管理公司 established by the Ministry of Finance as a bad bank one for each of the four commercial state-owned banks.

China Huarong Asset Management Co Ltd. Lai Xiaomin chairman of China Huarong Asset Management Co. The rescue plan made in an overnight Wednesday filing to.

Huarong transformed into a financial holding group in 2012 when Lai became its chairman. Zou said the dumping of US dollar bonds issued by Chinese property developers was a natural response from investors and were seen previously in. 在中華人民共和國註冊成立的股份有限公司 股份代號2799 臨時股東大會通知 茲通知中國華融資產管理股份有限公司 本公司謹訂於2021年12月2日星期四上午.

Known as just China Huarong Chinese. China Huarong Asset Management Co. From 2012 to 2018 when he was fired for graft was accused by a local Chinese court in the northern city of Tianjin of taking bribes.

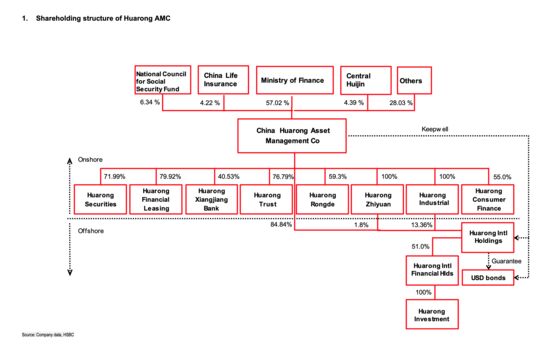

Asset management companies in China may refer to the four financial asset management companies AMC. Huarong Industrial is China Huarongs property-development platform and one of three first-level subsidiaries of China Huarongs distressed asset-management business. Chinese state-owned asset manager China Huarong Asset Management said on Wednesday it will receive fresh capital worth 42 billion yuan.

China Huarong Asset Management has been granted approval to raise 70 billion yuan 11 billion of financial bonds in the interbank market as it continues to improve its credit profile and re. China Huarong Asset Management Co Ltd. Chinese state-owned asset manager China Huarong Asset Management said on Wednesday it will receive fresh capital worth 42 billion yuan.

Huarong intends to issue a maximum of 3922 billion domestic shares and not more than 196 billion shares listed on the Hong Kong exchange to a consortium of investors including Citic Group China Cinda Asset Management and China Life Insurance among others. Has won regulatory approval to sell bonds to raise as much as 70 billion yuan 1095 billion three months after a government-backed rescue plan was secured to salvage the debt-ridden distressed-asset manager.

China S Huarong Asset Management Faces Severe Cash Crunch Warning To Lazy Investors

Huarong Mess Shows China S Need For U S Style Financial Reform

Huarong Drama Inside The Race To Avert Disaster At China S Biggest Bad Bank The Japan Times

China Huarong Seeks To Reassure Investors That It Can Repay Debt Caixin Global

Breaking Down China Huarong S Debt Case What It Means For China S Bond Market Pinebridge Investments

China Huarong Asset Management Wikipedia

Lai Xiaomin

3